Why “Slow” Q1 is Actually a Strategic Advantage

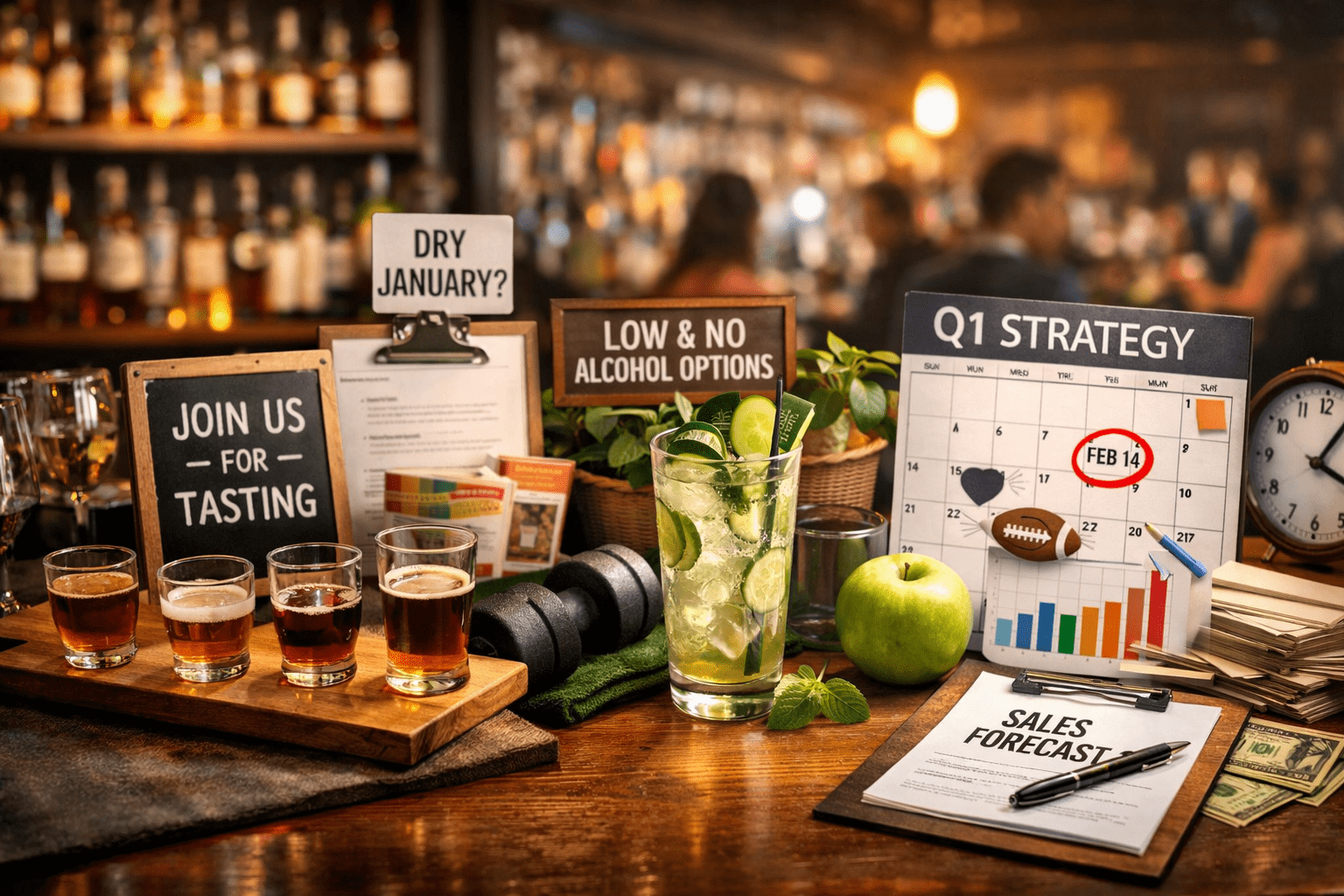

Let’s be honest — as folks who carry the bag, walk accounts, and sweat distributor politics, we feel Q1. Sales often crater after the holidays, Dry January and sober-curious behavior bite into consumption, and even category benchmarks show flat or down volume early in the year.

But here’s the part most brands miss: Q1 isn’t a slump — it’s a recruitment window. Too many teams retreat into discounting and hope. That’s playing defense, not strategy. The market shifts; your playbook should, too.

Understanding the Consumer Reset

After holiday spikes, consumers tighten wallets and rethink habits. Movements like Dry January and mindful drinking aren’t temporary trends, they’re reshaping early-year consumption patterns. Low- and no-ABV options have real traction because of this, not despite it.

That means two things:

- Traditional demand will be down.

- Selective, engaged demand is still very much alive — if you meet consumers where they are.

For context on the broader trend toward moderation and its impact on buying behavior, see this industry trend guide that highlights how low-alcohol and mindful drinking are reshaping category strategy.¹

Strategy #1 — Recruit Before You Sell

You’re not going to crush Q1 by leaning on the same tactics that work in November or December. Early year is about trial and education, not impulse purchases.

Here’s the blueprint:

- Experiential sampling — Make your tastings about education and discovery. Consumers in Q1 aren’t in a buy-now frame of mind; they’re in a learn-why-it-matters frame of mind.

- Joint programming with retailers — Create curated flights (even low-ABV flights) that tell a story, not just clear inventory.

- Rep storytelling — Arm your team with narrative hooks that connect product to lifestyle trends — whether it’s mindful drinking, balanced weekends, or artisan craftsmanship.

This is recruitment, not transaction selling, and it pays when the year heavies back into higher velocity months.

Strategy #2 — Lean Into the Better-For-You Reset

There’s a misperception that low- and no-alcohol options cannibalize core SKUs. That’s lazy thinking. Early in the year, moderation sells attention, not just volume.

Tactics that move the needle:

- Position low/no alcohol as complementary, not replacement. Put them next to core SKUs in sampling.

- Cross-promote with health & wellness partners — bars, yoga studios, fitness communities — to pull in the sober-curious who might later convert to paid alcohol.

- Digital storytelling that frames mindful drinking as choice, not concession.

This meets demand where behavior actually is in Q1, instead of where you wish it were. It’s not about abandoning your base, it’s about expanding your funnel.

Strategy #3 — Make Q1 Forecasting Work for You

Too many brands treat selling Q1 as a flat extension of the prior year. That’s a forecasting sin.

Q1 isn’t linear with Q4 — and your inventory plan shouldn’t be either.

Here’s what to do instead:

- Build a seasonal forecast using category and SKU trends not just historical dollars.

- Layer in promotional timing around relevant cultural moments (Valentine’s, Super Bowl, President’s Day) that can lift baseline demand.

- Calibrate inventory with real velocity signals — so you’re not overstocked during slow weeks.

A smarter forecast keeps you lean early and primed for the rest of the year.

Strategy #4 — Actively Engage On-Prem Early

Across markets, the on-premise is still the brand billboard. Doesn’t matter if it’s a neighborhood bar or a high-end restaurant, presence matters year-round.

Move faster than your competitors:

- Pre-season list drops — before menus reset for spring.

- Mixologist partnerships — build seasonal cocktails that position your brand as the choice for warmer markets ahead.

- Incentives tied to early list placements — not just velocity.

You’re not waiting for spring — you’re securing the list before spring hits.

Strategy #5 — Use Data to Target, Not Just Track

Data is meaningless if you don’t act on it. Some Q1 channels outperform others: grocery, convenience, and even digital commerce all behave differently early in the year.

Do this:

- Segment by shopper behavior — not just SKU performance.

- Match messaging to intent — discovery messaging for curious drinkers, quality messaging for premium buyers.

- Reallocate fast — if a tactic isn’t working by week four, pivot.

Velocity data should inform action, not just be archived.

The Q1 Opportunity Is Real — If You Treat It Like One

If you show up in Q1 with discounts and desperation, you’ll get discounts and desperation. If you treat it as a strategic recruitment and engagement window, you set up your whole year for better outcomes.

Here’s the blunt truth from someone who’s seen every cycle: you don’t win because Q1 is slow — you win in spite of it by outthinking the market. Start thinking like that today.

¹ Beverage Alcohol Industry Trends & Marketing Guide (Snipp Insights) — highlights growth in low-alcohol categories and shifting consumer behavior. https://www.snipp.com/hubfs/Snipp-Alcohol-Industry-Trends-Marketing-Guide.pdf